In “Truth Of The Stock Tape”, Gann provides an in-depth analysis of the stock market and its underlying principles. He believes that the stock market is governed by natural laws that can be studied and understood.

Gann emphasizes the importance of understanding the “tape” or the stock market data and charts, as they reveal the true trends and movements of the market. He provides a comprehensive explanation of how to analyze the stock market and make informed trading decisions based on the trends and patterns revealed in the tape.

According to Gann, “secret divergence” is a warning sign of an imminent trend reversal, and traders who are aware of this concept can take advantage of it to make profitable trades. He believed that by studying the underlying indicators and comparing them to the price movements of a security, traders can identify secret divergences and predict future market trends.

Gann’s approach to “secret divergence” was based on his belief that the stock market operates according to natural laws and patterns, and that these patterns can be studied and understood. He believed that by analyzing market data, traders could identify hidden divergences and use them to make informed trading decisions.

About Course:

Part 1: Who was W.D. Gann?

- The “1909 Ticker Digest” Interview

- Gann’s Certified Public Accountant Records 1933-1935

Part 2: Divergence Method of the Doomed Retail Trader

- What is Divergence?

- Regular Divergence

- Hidden Divergence

- Divergence Example (EURUSD)

- Problem With the Retail Method Of Divergence

Part 3: The Truth of The Stock Tape

- Reading Between the Lines – Case Study #1

- Reading Between the Lines – Case Study #2

- How to Learn and Analyze Gann – Case Study #1

- How to Learn and Analyze Gann – Case Study #2

- How to Learn and Analyze Gann – What is True in Both Case Studies?

- Application to Modern Markets

- Working Through Examples

Putting It All Together

- My Trading Plan

- Finding an Entry

- Placing Take Profit and Stop Loss Levels

Live Divergence Setups with Analysis

- Gold (XAUUSD) Short Example – January 26, 2022

- Dow Jones Long Example – January 27, 2022

- US OIL Long Example – January 31, 2022

- US OIL Long Example – February 1, 2022

- Dow Jones Long Example – February 1, 2022

- Gold (XAUUSD) Long Example – February 3, 2022

- UK OIL Long Example – February 9, 2022

- US OIL Long Example – February 10, 2022

- Gold (XAUUSD) Long Example – February 14, 2022

- USDCHF Long Example – March 10, 2022

- Silver (XAGUSD) Long – March 16, 2022

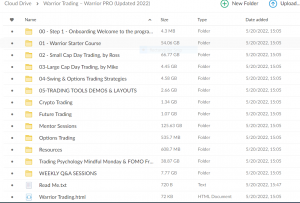

Live Webinars

- April 12, 2023(NY Session)

- April 21, 2023(NY Session)

- April 28, 2023(NY Session)

- May 8, 2023(NY Session)

- May 20, 2023(NY Session)

- May 26, 2023(NY Session)

- June 3, 2023(NY Session)

- June 30, 2023(NY Session)

- July 7, 2023(NY Session)

- July 28, 2023(NY Session)

- August 3, 2023(NY Session)

- August 11, 2023(NY Session)

- August 18, 2023(NY Session)

- USDCHF – Setup Update and Understanding the Next Step – August 22, 2023

- August 25, 2023(NY Session)

- September 1, 2023(NY Session)

Over 1.000 comments

Over 1.000 comments