Why Learn the Busted Breakout Trade Online?

Van Tharp Institute clients have been requesting a Forex Trading e-learning course consistently for the last few years. Now we’re proud to present this online course that will show you what it takes to trade Forex and teach you one great trading system.

It’s a system you will have a lot of fun with as it capitalizes on fishing for stops of inexperienced traders who get caught in bad trades (bull traps and bear traps).

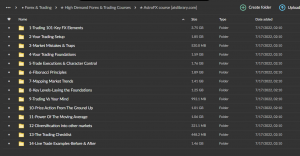

You can find the setup pattern in any chart – long-term charts and in short-term charts. Once you know how to spot them, you’ll probably be surprised at how many appear. If you prefer position trades lasting weeks or months, look at the GBPNZD pair using weekly bars. The long consolidation area from mid-2016 to early 2017 set-up the trader trap – it just snapped catching unexperienced countertrend traders. This is a short trade setup with a very attractive reward to risk ratio.

If you prefer a very short timeframe, see the 1min bar chart of the EURUSD pair below from July 6, 2017. Can you see the consolidation area and where the breakout below the range failed (or “busted” as Gabriel says)? You can study how Gabriel framed a long trade based on this setup and saw the price level for the entry, initial stop, likely stop-runs, and eventual target.

Course Overview:

Theoretical Foundations: A Comprehensive Exploration of Forex

In this course, Gabriel dedicates substantial lecture hours to delve into the intricacies of Forex trading, addressing inquiries such as:

- What motivates engagement in Forex trading?

- What are the merits and limitations of Forex trading in comparison to other asset categories?

- How does Forex trading differentiate itself in terms of market dynamics and its participant profile relative to other financial markets?

- Which strategies tend to yield optimal results within the Forex domain?

- An in-depth examination of Forex trading sessions and an array of currency pairs.

- Identification of distinctive features in Forex price chart characteristics, distinguishing them from those of stocks or futures.

- Selecting a Forex broker intelligently while avoiding potential pitfalls.

- Exploring the reasons why Forex might represent an ideal starting point for new traders to acquire trading expertise.

- Analysis of the most effective trading approaches that thrive within the realm of Forex.

Please be aware that the course’s quality is poor. We strongly recommend reviewing the provided sample before making a purchase decision.

Over 1.000 comments

Over 1.000 comments