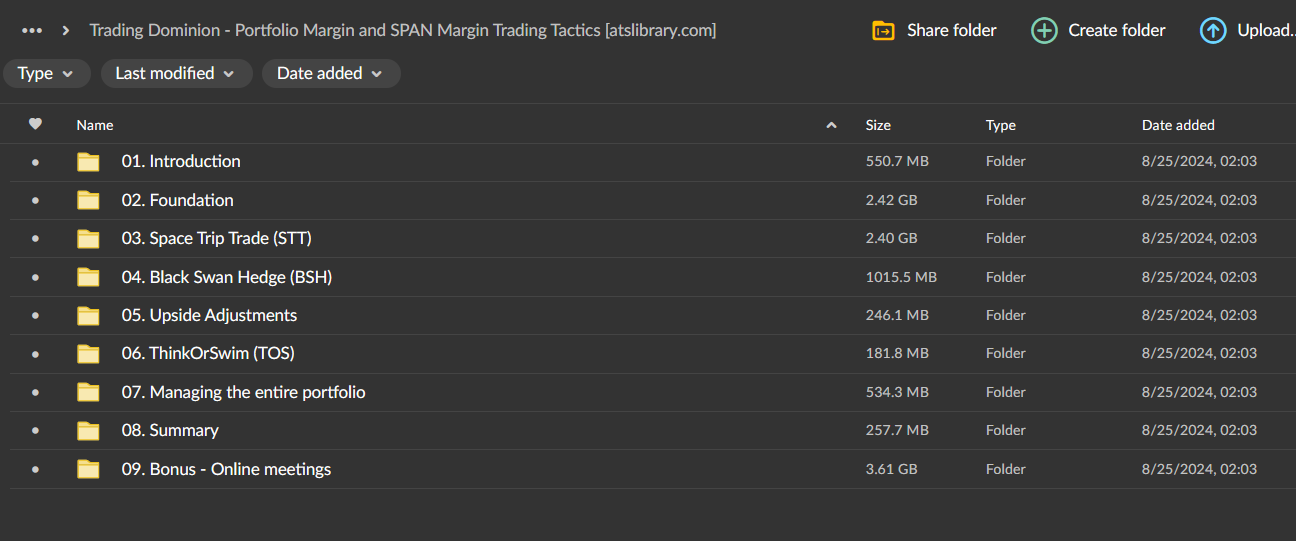

Trading Dominion – Portfolio Margin and SPAN Margin Trading Tactics Course

The Trading Dominion Portfolio Margin and SPAN Margin Trading Tactics Course is designed to provide traders with advanced knowledge and strategies for maximizing the potential of portfolio margin and SPAN margin accounts. This course is ideal for experienced traders looking to enhance their trading capabilities and leverage sophisticated margin techniques to increase their returns.

1. Introduction to Portfolio Margin and SPAN Margin

- What is Portfolio Margin?: Gain a comprehensive understanding of portfolio margin accounts, including how they differ from traditional margin accounts.

- What is SPAN Margin?: Learn about the Standard Portfolio Analysis of Risk (SPAN) margin system used primarily for futures and options trading.

- Benefits of Advanced Margin Accounts: Explore the advantages of using portfolio and SPAN margin, such as reduced margin requirements and increased leverage.

2. Margin Requirements and Risk Management

- Understanding Margin Requirements: Learn how margin requirements are calculated in portfolio and SPAN margin accounts.

- Risk-Based Margining: Discover how these accounts use risk-based margining to assess the potential risk of your portfolio and adjust margin requirements accordingly.

- Mitigating Risk: Develop strategies for managing the increased risks associated with higher leverage, including the use of stop-losses, hedging, and diversification.

3. Trading Strategies with Portfolio Margin

- Leveraging Positions: Learn how to use portfolio margin to increase the size of your positions without significantly increasing your risk.

- Spread and Arbitrage Strategies: Explore advanced trading strategies such as spreads and arbitrage that are more accessible with portfolio margin accounts.

- Maximizing Capital Efficiency: Discover how to optimize your capital allocation by using portfolio margin to free up capital for additional trades.

4. Trading Strategies with SPAN Margin

- Futures and Options Trading: Understand how to apply SPAN margin techniques specifically to futures and options trading.

- Dynamic Margin Adjustments: Learn how SPAN margin dynamically adjusts margin requirements based on market conditions and how to capitalize on this feature.

- Scenario Analysis and Stress Testing: Gain skills in using scenario analysis and stress testing within the SPAN margin framework to anticipate and manage potential risks.

Conclusion

The Trading Dominion Portfolio Margin and SPAN Margin Trading Tactics Course provides traders with the tools and knowledge necessary to effectively utilize advanced margin accounts. By mastering portfolio and SPAN margin strategies, traders can significantly enhance their trading performance, maximize leverage, and manage risks more effectively. This course is a must for those looking to take their trading to the next level and make the most of the opportunities that advanced margin accounts offer.

Over 1.000 comments

Over 1.000 comments