About Course

What’s wrong with investing in 2024?

- I don’t want to waste your time — the next 5 minutes are worth reading if:

- You have no idea which company’s stock to invest in, at what price to buy it, and whether those companies have the resilience and growth potential you seek.

- Watching the news causes you to second-guess your investment decisions. You are stuck in an emotional whirlwind, swinging between euphoria at positive headlines and despair at negative ones, clouding your investment judgment.

- You find yourself buying a company’s stock without fully understanding why you chose it. When its value dips by 30% or more, you panic and start questioning your decision.

- Valuing a business seems like a complex puzzle. You aren’t sure if a stock is under or overvalued. When market crashes happen, fear gets the better of you and you sell off without knowing the true worth of your investment, often resulting in losses.

- Your 9-to-5 job or other life commitments leave little time for thorough company analysis, yet you want to cultivate the skill and knowledge to know what information to focus on to make informed investment decisions.

- You tried learning to invest by watching YouTube videos or reading books, but you’re still unsure and lack a clear framework on how to analyze stocks.

- If these challenges resonate, you’re not alone.

Introducing:

The Steady Compounding Investing Academy

How it works:

Step 1:

Identify the traits of Steady Compounders

Success leaves behind a trail of clues.

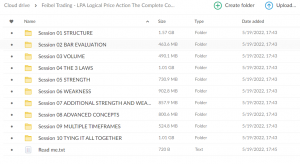

Modules 1 to 3 will teach you what it means to invest in the stock market and recognize the patterns of great businesses.

Step 2:

Analyze business performance

Make sense of a company’s financials and tell a story.

Modules 4 to 10 will teach you how to analyze financials, management earnings calls and how to easily keep track of quarterly business performance.

Step 3:

Master the art & science of valuation

Learn how to value businesses so you never overpay.

Modules 11 to 14 will teach you how to value businesses using first principles.

Step 4:

Portfolio & risk management

Construct a resilient portfolio that will stand the test of time.

Modules 15 to 16 will cover business risks, diversification, portfolio construction and behavioral psychology.

Over 1.000 comments

Over 1.000 comments