The Altcoin Investing Course is a 9-module course taught by Cryptocurrency analyst and dealer Rekt Capital, aimed toward serving to you higher perceive and navigate the Altcoin market.

Rekt Capital’s earlier “Technical Evaluation” and “Danger Administration” programs each have an total score of 5 out of 5.

OVERVIEW

– 9 Video Lectures

This densely-packed course options Rekt Capital’s distinctive cutting-edge analysis that basically makes a distinction to you as an Altcoin dealer and investor. Complicated market phenomena are distilled into exact, actionable insights that can make it easier to higher navigate the Altcoin market.

– 2 x BONUS Tutorials From Rekt Capital’s Earlier Programs

Early birds of the Altcoin Investing Course will obtain 2 x Bonus Video Tutorials from Rekt Capital’s earlier programs: “Buying and selling View: My Setup, Suggestions and Tips” from the Technical Evaluation course and “Portfolio Structuring and Diversification” from the Danger Administration course.

ABOUT REKT CAPITAL

Rekt Capital is a cryptocurrency dealer and analyst and writer of the Rekt Capital E-newsletter – the #4 Crypto e-newsletter on Substack globally. His market analysis and evaluation has been featured in Forbes, CoinTelegraph, Actual Imaginative and prescient, Hackernoon, BraveNewCoin, and Medium’s largest publication The Startup.

WHY LEARN ABOUT THE ALTCOIN MARKET?

Bitcoin has been the very best performing asset over the previous ten years.

In truth, the worth of Bitcoin has elevated by +1400% inside a yr (i.e. March 2020 – March 2021).

However what is not talked about almost as usually is that different cryptocurrencies have appreciated considerably as effectively, some much more than Bitcoin. This is a quick listing of solely a few of the Altcoins that outperformed Bitcoin throughout that very same one yr time interval from March 2020 to March 2021:

– Ethereum (+2,200%)

– Chainlink (+2,200%)

– Binancecoin (+5,500%)

– Cardano (+8,100%)

– Zilliqa (+10,200%)

Because the cryptocurrency area continues to evolve, there may be an rising legit curiosity from traders to diversify their crypto holdings into different promising crypto-assets that would supply a profitable Return On Funding. If something, the aforementioned Altcoins are a testomony to the truth that it is value attempting.

Altcoins can determine as highly effective wealth-generating automobiles if strategically invested in.

Sadly, most Altcoin funding choices are made primarily based purely on emotion and lack of perception.

However the Altcoin market is ruled by a couple of essential ideas that, if mastered, will basically change the way you method your Altcoin buying and selling and investing.

By this course, you’ll be taught to know the Altcoin market and the ideas that govern its cyclical actions to be able to successfully navigate the Altcoin market as an investor.

CLICK “I Need This!” To ENROL NOW

WHO SHOULD TAKE THIS COURSE?

Anybody who’s enthusiastic about enhancing their understanding of the Altcoin market and studying methods to navigate it profitably and successfully will discover the knowledge introduced on this course extremely useful and sensible.

This densely-packed course options actionable insights that can actually make a distinction to you as to learn how to commerce and put money into Altcoins. It has been designed for these seeking to find out about learn how to higher navigate the Altcoin market with out spending numerous hours on impartial analysis.

The cutting-edge insights coated within the course are advanced and intellectually difficult however are introduced in a simple to observe, digestible method.

HOW WILL THIS COURSE HELP YOU?

• Study Altcoin Market Cycles and the traditionally recurring themes of their motion to raised perceive the place Altcoins are of their total cycle at any given time.

• Perceive the distinctive relationship between Bitcoin Market Cycles and Altcoin Market Cycles. How they differ, how they co-occur, and learn how to spot transitional durations that precede both new Altcoin Bull Markets or new Altcoin Bear Markets.

• Discover ways to determine durations of most monetary alternative in Altcoins vs. durations of most monetary threat and discover ways to place your self accordingly.

• Perceive the particular market situations that allow sturdy Altseasons to happen.

• Discover ways to time the start and finish of an Altseason.

• Uncover a wide-variety of Altcoin correlations that can prevent time in selecting the funding that finest aligns together with your time horizon preferences, threat profile, private investing fashion, tolerance to threat, in addition to distinctive persona inclinations.

• Enhance your capability to independently spot promising Altcoin alternatives.

• Discover ways to proactively construct a cryptocurrency portfolio in step with Cash Circulation ideas to be able to strategically capitalise on prevailing traits in investor revenue circulation.

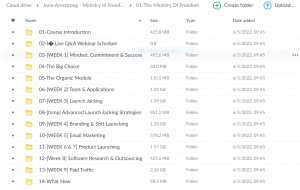

COURSE MODULES:

Lecture 1 – Altcoin Market Cycles

This lecture introduces Altcoin Market Cycles and why it’s best to find out about them.

Rekt Capital discusses the assorted patterns and tendencies that traditionally recur in these cycles and the way greedy the ideas that govern these cycles will tremendously enhance one’s capability to successfully navigate the Altcoin market.

Lecture 2 – Altcoin Bull and Bear Markets

This lecture focuses on segmenting Altcoin Market Cycles into durations of low- and high-profitability.

You may discover ways to determine durations of most macro monetary alternative in Altcoins in addition to durations of macro most macro monetary threat and discover ways to place your self accordingly. Rekt Capital shares metrics he personally finds helpful in figuring out topping-out indicators on Altcoin traits.

Lecture 3 – Bitcoin Halving Impact On Altcoins

This lecture is devoted to exploring the Bitcoin Halving impact on the costs of Altcoins. Bitcoin’s value modifications related to the Halving shall be examined within the context of how Altcoins behave in tandem with Bitcoin.

Maybe most significantly – this lecture will discover the distinctive relationship between Bitcoin Market Cycles and Altcoin Market Cycles: how they differ from each other, how they co-occur, and learn how to spot transitional durations that precede both new Altcoin Bull Markets or new Altcoin Bear Markets.

Lecture 4 – Altcoin Hype Cycles

This lecture is concerning the seasonality in Altcoin value appreciation and depreciation.

You may discover ways to recognise Altcoin Hype Cycles and learn how to navigate them successfully with assistance from distinctive instruments and metrics.

Historic Altcoin Hype Cycles are additionally examined to infer the particular market situations that allow these Hype Cycles, which situations disrupt them, and learn how to leverage this historic information to you benefit in your buying and selling and investing.

Lecture 5 – Altcoin Correlations

Uncover a wide-variety of Altcoin correlations that can prevent time in selecting Altcoin investments that finest fit your private preferences. Understanding Altcoin Correlations will tremendously help your decision-making when choosing the proper funding for you.

Lecture 6 – Altcoin Lag Cycles

Study Altcoin/USD cycles and the Altcoin/BTC cycles that observe.

This lecture discusses the lagging relationship between these cycles and the way they co-occur. It explores durations of discorrelation, recorrelation, and decorrelation.

You may discover ways to distinguish between phases in order that you understand which Altcoin pairings shall be extra worthwhile primarily based on the place Altcoins are within the Market Cycle at any given time.

Lecture 7 – How To Time Altcoin Development Acceleration

Discover ways to strategically utilise Altcoin/ETH value charts to identify and time Altcoins which can be on the cusp of pattern acceleration.

This lecture focuses Altcoins that lag behind Ethereum and discusses the market situations that allow these similar Altcoins to drastically outpace Ethereum.

Lecture 8 – When Do Sturdy Altseasons Happen?

Discover ways to distinguish the several types of Altseasons utilizing cutting-edge technical metrics.

Rekt Capital covers the distinctive relationship between Bitcoin Market Cycles and Altcoin Market Cycles and descriptions how particular Bitcoin value strikes can supply predictive perception into future Altcoin value traits.

Lecture 9 – How To Time The Starting and Finish of an Altseason

Be taught when to enter Altcoins, when to exit, in addition to when to fully keep away from them.

This lecture addresses the particular market situations that allow will increase in Altcoin valuations in addition to the warning indicators that precede their depletion. Discover ways to detect essential indicators of an Altseason coming to an finish and learn how to appropriately put together for it.

Right here, Rekt Capital explores a wide range of time-tested indicators and metrics that reliably precede Altcoin Seasons and their peaks.

He cross-references them with each other to construct an efficient and cohesive system to figuring out early-stage bullish or bearish Altcoin pattern reversals.

BONUS Lecture 10 – Buying and selling View: My Set Up, Suggestions and Tips

This video tutorial is from Rekt Capital’s “Technical Evaluation” course that has an total score of 5 out of 5 and options as a bonus lecture on this course.

On this lecture, Rekt Capital reveals how he utilises Buying and selling View to determine promising Altcoin set-ups. He shares a wide-variety of private suggestions and methods that assist him assemble a stellar Altcoin watchlist and discusses how he approaches his watchlist to determine the absolute best commerce or funding.

BONUS Lecture 11 – Portfolio Structuring and Diversification

This video tutorial is from Rekt Capital’s “Danger Administration” course that has an total score of 5 out of 5 and options as a bonus lecture on this course.

This lecture focuses on learn how to construct your cryptocurrency portfolio whereas bearing in mind a wide-variety of threat administration ideas. Portfolio segmentation methods and revenue circulation ways are explored.

Over 1.000 comments

Over 1.000 comments