About Course:

- This market timing trading system is a rules-based trading system for use on ETFs, stock index futures and/or index options.

- It is simple enough to be learned by novices and can be executed by keeping up with key indicators in under ½ hour per day.

- It also can be rapidly adopted by experienced professionals, adding a defendable edge to their trading process and improving the assessment of reward/risk on any trade by highlighting the key best reward/risk opportunities when tops and bottoms occur, and when corrections against the main trend (up or down) are over so that asymmetric opportunities are revealed and can be maximized.

- The system can help you generate larger gains regardless of your trading performance so far and on any strategy, you use that exploits trend following on any timeframe.

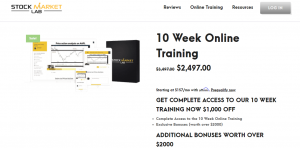

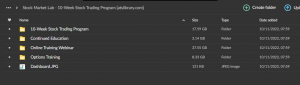

What’s included:

- Strategies include the High Yield Strategy which has returned 10% per year with a maximum drawdown of 12% and never had a losing year in 27 years.

- Supporting REED$TRADER Market Timing Course Resources

- Stock Market Timing Guide

- REED$TRADER Special Report: How to Know When a Rally Really Has Legs PDF.

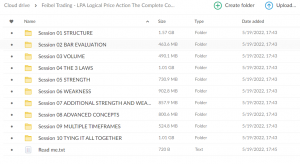

- Introduction to the Reeds Internals Market Timing system

- Identifying Bull Market Top Checklist

- Identifying Bear Market Bottoms Checklist

- Going over Market Internals

- Short hedging in bull markets

- How to use the Market Timing Strategy for trading

- ETF’s and leveraged ETF’s (401k’s)

- Futures

- Catching Corrections Against the Trend

- Correction signal indicators

- Correction over indicators

- How Great Timing can explode the trading profits of nearly any strategy for trading intermediate-term, long-term, and even short-term trends

- How to locate and turbo-charge wildly asymmetric opportunities in trading

- Access to 2 LIVE office hour sessions

Over 1.000 comments

Over 1.000 comments