Advanced Orderflow Training

Mastering the OrderBook

Find Consistency in Your Trading and Start Picking Winners 60%, 70% and as much as 90% of the Time with the Orderbook…

After the incredible feedback I’ve received from 1000’s of people who have watched my DOM Trading Course, I’ve decided to offer some more advanced training for those who are interested in learning how to trade with the orderbook.

The goal is simply to help newer traders read the orderbook and identify buyers and sellers and then show you how to build trading strategies around those spots.

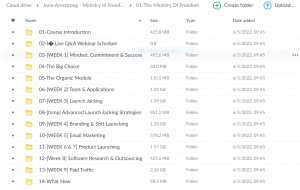

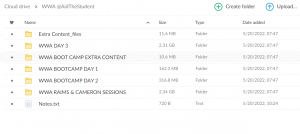

To do this I have put together over 2 hours of advanced theory videos and added 5 hours of live webinar recordings where I talk through the price action in real time.

2 hours of Advanced Course Material

5 hours of Webinar Recordings

Bonus: Trade Setups

The webinar series ran over a 4-week period and featured the FESX/DAX, which are the main European equity futures markets.

I have also identified some great trade setups in spots where you could have easily made 10-20 ticks in what I consider an A+ DOM setup.

Learn how to trade this setup and you will be well on your way to profitability.

Mastering the Orderbook

Advanced Training Videos + Webinar Recordings

Part 1:

- Reading the orderbook

- Spotting buyers and sellers – Iceberg Orders

- Incorporating Volume Profile

- Inflection points

Part 2:

- Using correlated markets to gain an edge

- The role of VWAP in trade decisions

- Highs & Lows

- Breakouts/Reversals

- Fake bids/offers

- Position in Queue

- Managing exits

Part 3:

- Identifying Good Risk/Reward Opportunites

- The best setups for new traders

- Morning Preparation

- Support/Resistance and Market Profile Areas

- Economic Data releases

Part 4:

- The opening drive

- Times of day to trade

- Developing your edge

- Journals + Playbooks

- Tracking Statistics

Over 1.000 comments

Over 1.000 comments