Description of Traders Online Training Package

This Coaching Package includes some of the most UNIQUE methods for trading with Auction Market Theory, Volume\Market Profile and Order Flow Trading Techniques.

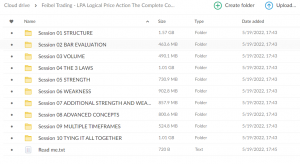

View a SAMPLE from our L2ST Online Training Package below where Kam Dhadwar talks about DOM Analysis which is then followed by a Live Trade taken using TT X Trader on the Emini S&P.

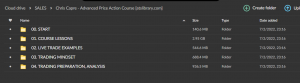

What will you learn in Traders Online Training Package?

Understand the Market Structure and Market Participants Expected Behaviours for the Highest Probability Trades:

- Applying Auction Market Theory and Understanding Market Participants Expected Behaviours.

- Understanding the use of Market and Volume Profile – Reading Acceptance and Rejection of price and how to trade it.

- Learn how to practically trade Intraday Day with the Market\Volume Profile.

- Learn how to identify the most powerful Market\Volume Profile Levels.

- Identifying Value and learning how to use Value for trading.

- Highlighting Developing Structure – Balanced and Imbalanced phases.

- Trading with the VWAP and Developing Value.

Identifying High Probability Trading Opportunities – Learn the Specific L2ST Trade Setups:

- Read price Rejection and Acceptance and understand how to use this for the best trade location and execution that will help reduce risk.

- Identifying and Trading Divergences using the Volume Breakdown – Understand when to use Hidden and Regular Divergence, and know when to ignore divergence!

- Understand how to know in advance when the market is getting ready for a reversal.

- Highlighting Price and Value Relationship Trading Opportunities- Know when to trade which setups with the Art of Adaptive Trading Methodology.

- Trading with an understanding of Volume, Price and Value.

Understanding Risk and Reward Potential in Trades:

- Learn how to determine Predefined Maximum Risk.

- Understand the importance of accepting Risk in Trading.

- Learn the L2ST Risk Management Model for efficient control of Risk and helping identify Position sizes that should be traded.

- Highlighting Risk before entering a trade.

- Highlighting Potential Reward before entering a trade.

- Using Volume Profile Levels for Maximising Profits.

Learn how to Confirm Trade Setups with the Real Time Order Flow and Price Transparency for better Execution:

- Understanding Market Delta Footprints.

- Reading the Depth Of Market (DOM) effectively.

- Reading Pre and post Trade Supply and Demand, and how to use it to confirm trades or ignore trades.

- Understand how to use and trade with Bid\Ask Volume information.

- How to interpret Developing Delta.

- Learn how to trade Responsive trade and Initiated trade.

Learn the importance of effective Risk and Trade Management:

- Learn how to Manage and Minimising Risk in open trades.

- Learn the Discipline to cut and scratch trades by reading Order Flow.

- Understand how to Scale in and out of trades for effective Risk Management and to maximise profit potential.

Over 1.000 comments

Over 1.000 comments