Investing in Yourself

The fundamental principle of learning anything, especially trading, is to invest in yourself. The belief in evolutionary psychology underpins this idea: investing time and finances creates value. This course is designed to ensure you have a significant buy-in factor, making learning nearly automatic as your brain focuses intensely on the material.

Course Structure

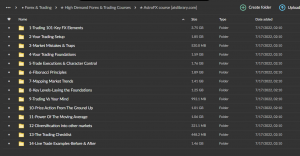

Introductory Module

- What is Technical Analysis: Understanding the basics.

- Why and How Technical Analysis Works: The methodology behind it.

- Professional Technical Analysis: What sets professionals apart.

- Maximizing the Program: Tips for getting the most out of the course.

Technical Analysis Tools and Advanced Applications

- Candlestick Formations: Recognizing and interpreting candlesticks.

- Horizontal Support/Resistance: Key levels in price charts.

- Volume Analysis: Understanding market volume.

- Candlestick Patterns: Identifying and using patterns.

- Exponential Moving Averages (EMA): Calculating and applying EMAs.

- Relative Strength Indicator (RSI): Measuring market strength.

- Stochastics: Using stochastic indicators.

- Volume Profile: Analyzing volume distribution.

- Order Blocks: Identifying and using order blocks.

- TD Sequential: Understanding and applying TD sequential.

- Fibonacci Retracements: Using Fibonacci for price targets.

Interpreting Indicators

- Market Cycles and Dynamic Interpretations: Understanding different market phases.

- Bull Market

- Bear Market

- Consolidation

- Market Fundamentals: Key principles and analysis.

Confirmation Trading

- Entry and Exit Strategies: Timing your trades.

- Advanced Strategies: Enhancing your trading approach.

Risk and Position Management

- Determining Risk vs. Reward: Balancing potential returns and risks.

- Identifying Opportunity Cost: Evaluating trade-offs.

- Leveraged Trading Strategies: Using leverage effectively.

Taking Profits

- Defining Target Areas: Setting profit goals.

- Advanced Layering Strategies: Optimizing profit-taking.

Market Dynamics

- Underlying Market Fundamental Analysis: Understanding market drivers.

- Liquidity Pools: Recognizing and using liquidity pools.

- Institutional Order Flow: Insights into institutional trading.

- Market Sentiment: Gauging market mood.

- Driving Human Psychology: The role of psychology in trading.

Bonus Modules

- Setting Up TradingView: Getting started with TradingView.

- Portfolio Tracking and Auto Balancing Spreadsheet: Tools for portfolio management.

- BitMEX Tutorial: Using BitMEX effectively.

- The 21 Exponential Bonus Strategy: Advanced EMA strategy.

- Daily Simplistic Moving Average Bonus Strategy: Daily MA strategies.

- Macro Market Cycle Indicator Master Bonus Strategy: Understanding market cycles.

- The Stochas-Ta-Cult Bonus Strategy: Using proprietary stochastic indicators.

- Advanced Stochas-Ta-Cult Bonus Strategy: Advanced stochastic strategies.

- Introduction to Deribit Exchange: Getting started with Deribit.

- Daily EMA + SMA Strategy: Combining EMAs and SMAs.

- MACD Mastery: Mastering the MACD indicator.

- Bollinger Band Mastery: Using Bollinger Bands.

- Accumulation/Distribution Indicator Mastery: Analyzing accumulation and distribution.

- Krown Trading Stochastics (Proprietary Indicator): Using proprietary indicators.

- Long Term Trend Slope Analysis & Strategy: Long-term trend strategies.

- The Three Hour Stochastic Strategy: Specific stochastic strategies.

- Krown Trading DMI + Strategy: Using the DMI indicator.

- Trade & Account Manager Excel Tool: Tools for managing trades and accounts.

- Divergence Entry & Exit Mastery: Mastering divergence strategies.

Conclusion

The Krown Trading – Trade Like a Professional course offers comprehensive training in technical analysis and trading strategies. With nearly 28 hours of content, it’s designed to provide deep insights and practical tools to help you achieve long-term success in cryptocurrency trading.

Over 1.000 comments

Over 1.000 comments