About PDFs:

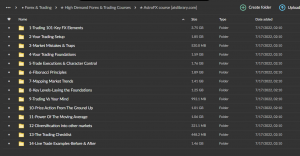

Trading with the Time Factor Vol.1 course outline

- Trading With the Trend

- How the mathematical and geometric relationships work in the market

- An introduction to W.D. Gann, Fibonacci and Elliott Wave theory

- How to identify and trade with the trend

- Gann Swing Charts

- Identifying Sections of the Market

- Overbalancing of Time and Price

- The best trend measuring techniques used by the professionals

- How to use trend lines, trend channels and moving averages

- How to Forecast Price

- Price Retracements

- Determining major and minor price ranges

- How to know when a Fibonacci retracement will hold

- Using previous market prices to forecast future market prices

- Price projections: forecasting future tops and bottoms to the exact point

- Detailed example of how I forecast the S&P 500 top in September 2012 to the exact point

- How to Determine the Strength of a Market

- Using Pitch Lines to determine the strength of a market move

- The ‘Barillaro Box: my own trend tracking indicator

- The ‘Barillaro Angle’: my own price forecasting technique

- An Introduction to Time

- Time & Price angles

- How to know which Time & Price angle to use

- Gann Master Square calculators

- The Best Trade Entry and Exit Techniques

- The five rules for risk management

- Entry and exit points for trades with the trend

- Entry and exit points for trades against the trend

Trading with the Time Factor Vol.2 course outline

TOPICS COVERED INCLUDE

UNDERSTANDING THE TIME FACTOR

- – How to identify repeating time frames within a market

- – How the major time frames work in the market

- – The key time frames ending the 20 year bear market in gold

- – The time cycles calling the 2011 all-time high in gold

- – Anniversary dates

- – trading to Time – my own proprietary forecasting tool

- – knowing when a trading to Time date will work

- – how to calculate and divide a yearly cycle of time

- – the highest probability time counts

- – how to calculate calendar time into degrees (simply)

- – the predictable yearly highs and lows in 2000 and 2001 (ASX 200)

- – the repeating time counts in 2011 and 2012 (S&P500)

Over 1.000 comments

Over 1.000 comments