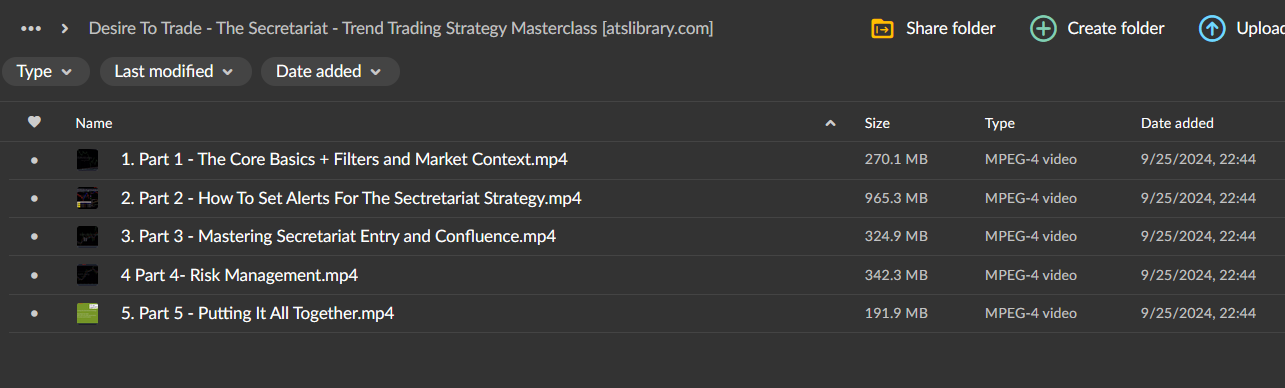

Desire To Trade – The Secretariat – Trend Trading Strategy Masterclass

Introduction

The Secretariat – Trend Trading Strategy Masterclass by Desire To Trade is a specialized course aimed at traders who want to master the art of trend trading. This course provides a detailed breakdown of trend trading strategies, focusing on how to identify, enter, and exit trades in trending markets. The Secretariat offers traders a robust framework to improve their trading performance by capitalizing on market trends.

Course Structure

Introduction to Trend Trading

- Understanding Market Trends: Overview of different types of trends (uptrend, downtrend, sideways) and their significance in trading.

- Why Trend Trading Works: Explanation of the underlying principles of trend trading and why it’s a popular strategy among traders.

- Key Trading Psychology: Importance of developing the right mindset to execute trend trading strategies effectively.

Identifying Trends

- Technical Indicators for Trend Detection: Introduction to key technical indicators such as moving averages, MACD, and RSI used to identify trends.

- Chart Patterns and Trendlines: How to use chart patterns and trendlines to confirm trends and potential entry points.

- Market Cycles: Understanding different phases of market cycles and how they relate to trend trading opportunities.

Entry and Exit Strategies

- Trend Confirmation Techniques: Strategies for confirming trends before entering a trade, including multi-timeframe analysis.

- Entry Points: Detailed guide on identifying optimal entry points using support and resistance levels, Fibonacci retracements, and other tools.

- Exit Strategies: Techniques for determining exit points, including trailing stops, profit targets, and risk management practices.

Risk Management and Position Sizing

- Risk Management Fundamentals: Importance of managing risk in trend trading and how to set appropriate stop losses.

- Position Sizing: How to calculate position sizes based on account size, risk tolerance, and market conditions.

- Adjusting Strategies for Volatility: Adapting trend trading strategies to different levels of market volatility.

Advanced Trend Trading Techniques

- Trading Multiple Timeframes: Using multiple timeframes to refine entry and exit points and to manage trades more effectively.

- Diversification of Trend Strategies: Applying different trend trading strategies across various asset classes (e.g., Forex, stocks, commodities).

- Algorithmic Trend Trading: Introduction to automating trend trading strategies using trading bots and algorithms.

Key Features

- Comprehensive Strategy Breakdown: The course offers a step-by-step guide to mastering trend trading, from identifying trends to executing and managing trades.

- Focus on Practical Application: Emphasis on real-world examples, live trading sessions, and practical exercises to ensure traders can apply what they learn.

- Expert Instruction: Led by experienced traders who have successfully implemented trend trading strategies in various markets.

Conclusion

The Secretariat – Trend Trading Strategy Masterclass by Desire To Trade is an essential course for traders who want to refine their trend trading skills. Whether you’re new to trading or have experience in the markets, this course provides the tools and strategies needed to capitalize on trending markets. By combining technical analysis with sound risk management, traders can increase their profitability and confidence in executing trend-based trades. This masterclass is a valuable investment for anyone serious about improving their trading performance.

Over 1.000 comments

Over 1.000 comments