First, the fundamental concept is that all units of time can be divided by four into quarters — just as we look at the year’s corporate reporting cycle of Q1, Q2, Q3, and Q4.

Dividing the day by four, into six hour quarters and again into 90 minute quarters and again into 22.5 minute ‘Micro’ quarters we reach the smallest unit shown by this indicator. Apply it to your NQ1! or ES1! charts and you may see remarkable confluence with the ICT macro times!

Why would we want to do this? It helps us understand, visualize and predict ICT’s PO3 concept:

• A – Accumulation (required for a cycle to occur)

• M – Manipulation

• D – Distribution

• X – Reversal/Continuation

Did ICT invent accumulation, manipulation and distribution? No, but his branding and teaching of price action is second to none, so we’ll roll with it.

The bottom line – we want to sell after a manipulation (M) up, or buy after a manipulation down and Quarterly Theory plots times on your chart where this may occur. Every asset is different, so back-test and research!

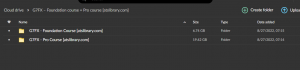

Gova Trading Academy – GTA Professional Course

Gova Trading Academy – GTA Professional Course

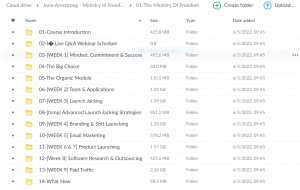

High Performance Trading – Profit Freedom Blueprint

High Performance Trading – Profit Freedom Blueprint

Daye Quarterly Theory (DQT) – LiquidityPro

Original price was: $150.00.$14.99Current price is: $14.99.

-90%Price in official website: 150$

We offer in just : 14.99$

Product Delivery : You will receive download link in mail or you can find your all purchased courses under My Account/Downloads menu.

Over 1.000 comments

Over 1.000 comments