What is Market Profile in Forex Trading?

Market Profile is a unique charting technique that represents price distribution over time. It helps traders visualize market behavior, identify key price levels, and understand the balance between buyers and sellers.

- Key Components:

- Value Area (VA): The price range where most trading occurred (typically 70% of total volume).

- Point of Control (POC): The price level with the highest trading activity.

- Initial Balance (IB): The range of the first trading session period.

- Time Price Opportunity (TPO): Individual units showing how long the price stayed at a certain level.

Course Objectives

This course aims to enhance your ability to:

- Use Market Profile concepts to identify market trends and reversals.

- Apply Forex-specific strategies that maximize profitability.

- Build a disciplined trading mindset and improve decision-making skills.

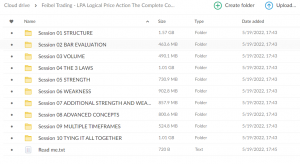

Course Structure

Module 1: Fundamentals of Forex Trading

- Overview of the Forex market: Major players, currency pairs, and trading sessions.

- Basics of technical and fundamental analysis.

- Understanding leverage, margin, and risk management.

Module 2: Introduction to Market Profile

- Historical background of Market Profile.

- Structure of a Market Profile chart.

- Differences between traditional candlestick charts and Market Profile.

Module 3: Integrating Market Profile with Forex

- Identifying high-probability trade setups using Market Profile.

- Recognizing key support and resistance levels.

- Interpreting the Value Area, POC, and TPO clusters in Forex trading.

Module 4: Advanced Trading Strategies

- Combining Market Profile with technical indicators like RSI, MACD, and Fibonacci retracements.

- Strategies for trending versus ranging markets.

- Using Market Profile for scalping, day trading, and swing trading.

Module 5: Risk Management and Psychology

- Setting stop-loss and take-profit levels based on Market Profile insights.

- Managing position sizes to minimize losses.

- Developing emotional discipline and avoiding common trading pitfalls.

Benefits of the Course

- Improved Market Understanding: Learn to decode market sentiment and structure.

- Enhanced Decision-Making: Make informed trading decisions based on statistical probabilities.

- Versatility: Applicable to various timeframes and trading styles.

- Real-World Examples: Hands-on practice with live market scenarios and case studies.

Who Should Enroll?

This course is ideal for:

- Aspiring traders new to Forex or Market Profile.

- Experienced traders looking to refine their strategies.

- Financial analysts and professionals interested in Forex markets.

Key Takeaways

By the end of the course, participants will be able to:

- Confidently analyze and trade using Market Profile techniques.

- Apply proven strategies to identify profitable opportunities.

- Build a robust risk management plan tailored to Forex trading.

Conclusion

Strategic Trading – Forex Meets the Market Profile is a comprehensive course that bridges the gap between traditional Forex strategies and advanced Market Profile techniques. Whether you’re a beginner or a seasoned trader, this course equips you with actionable insights to excel in the dynamic Forex market. Take the first step towards mastering strategic trading today!

Over 1.000 comments

Over 1.000 comments