About Course:

“Hypergrowth” Options Strategy

- Options Trading for Beginners PDF Download

- Introduction to Data-Driven Options Strategies

- Hypergrowth Strategy Characteristics & Expectations

- Hypergrowth Intro – What is It?

- Required Stock Growth Rate (Spreadsheet)

- SPY Results: Individual Trades 2008-2022

- Key Trade Stats & Performance vs. Implied Volatility

- Strategy Viability Before & After 2008-2022

- Simple Hypergrowth Portfolio vs. SPY Investing

- Strategy Updates: 2022 to 2024

- Analyzing Trade Scaling Strategies

- Trading the Strategy in Small Accounts?

- Trade Management Approaches Analyzed

- Trade Entry & Sizing Considerations

- Reverse-Engineering 5-10x Trades

- Using Technical Levels for High-Probability, High Return Entries

- Hypergrowth 2023 Entries Updates (SPY, QQQ, AAPL, AMZN, GOOGL, NVDA, TSLA)

- Bull Call Spreads for Small Accounts (Intro)

Real Trades, Commentary, and Bonus Videos

- Why MSTR is the Biggest Trading Opportunity Right Now (Initial Presentation 11/2023)

- Positions Update November 26th, 2023

- Positions Update December 13th, 2023

- Positions Update January 2nd, 2024

- Positions Update January 16th, 2024

- Positions Update February 9th, 2024

- Positions Update March 4th, 2024

- Positions Update March 15th, 2024

- How to Generate Income on Long-Term Call Positions | Part 1

- Positions Update May 8th, 2024 (MSTR/IBIT Rotation Strategy, Call Spreads vs. Calls & More)

- Positions Update October 2024

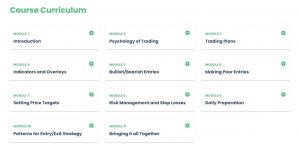

SPY Monthly Iron Butterfly Strategy

- Introduction

- First Options-Selling Strategy Introduction

- Strategic Strike Price Selection

- Reducing Risk with Time-Based Trade Management

- Initial Strategy Results (SPY 2008-2023)

- Options Strategy Portfolio Results with Trade Sizing Approach #1

- Options Strategy Portfolio Results with Trade Sizing Approach #2

- Specific Trade Performance Details Analysed

- Trade Example Walkthroughs and Adjustments Visualized w/ Optioned Explorer

- Trade Entry/Exit Demos on tasty trade

Volatility Trading Strategy (VXX) – In Progress

- Strategy Preview

- Introduction – Understanding VXX

Over 1.000 comments

Over 1.000 comments