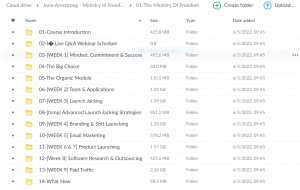

Course Content

| My Drive > Michael Valtos – Order Flow Trading Course |

| OFTC Lesson 1-4 |

| OFTC Lesson 5-9 |

| OFTC Lesson 10 – 11 |

| OFTC Lesson 12 – 13 |

| OFTC Lesson 14 – 15 |

| OFTC Lesson 16 – 18 |

| OFTC Lesson 19 – 20 |

| OFTC Lessons pdfs |

| Trading Order Flow.pdf |

Michael Valtos – Order Flow Trading Course

Michael Valtos’ Order Flow Trading Course is a comprehensive educational program designed to empower traders with a deep understanding of market dynamics and enhance their ability to make informed trading decisions. As a respected figure in the trading community, Michael Valtos brings his extensive experience to the forefront, providing participants with valuable insights into the intricacies of order flow analysis.

At the core of the Order Flow Trading Course is the focus on understanding and utilizing order flow data. Unlike traditional technical analysis that primarily relies on price and volume, order flow analysis dives into the actual transactions taking place in the market. By deciphering the flow of orders, traders gain a unique perspective on market sentiment, liquidity, and potential price movements.

The course begins by demystifying the concept of order flow, breaking it down into digestible modules suitable for traders at various skill levels. Participants are guided through the fundamentals, learning how to interpret order book data, identify key market participants, and recognize significant order flow patterns. This foundational knowledge sets the stage for more advanced strategies and techniques introduced later in the course.

One of the distinguishing features of Michael Valtos’ course is its practical approach. The Order Flow Trading Course doesn’t just provide theoretical knowledge; it equips traders with practical tools and strategies that can be immediately applied in real-world trading scenarios. Through live examples, case studies, and hands-on exercises, participants learn how to integrate order flow analysis into their existing trading methodologies.

Valtos places a strong emphasis on risk management within the course, recognizing its crucial role in successful trading. Traders are educated on how to use order flow data to identify low-risk, high-probability trading opportunities, and how to manage their positions effectively to preserve capital. This holistic approach to trading ensures that participants not only understand order flow dynamics but also develop the skills to navigate the market with discipline and resilience.

The Order Flow Trading Course is structured to cater to traders with diverse backgrounds and experience levels. Whether you are a novice looking to grasp the fundamentals of order flow or an experienced trader seeking to refine your skills, the course provides a progressive learning path. The modular nature of the content allows participants to absorb the material at their own pace, ensuring a thorough understanding before progressing to more advanced topics.

Michael Valtos’ course also stands out for its commitment to ongoing support and community engagement. Participants gain access to a community of like-minded traders, creating an environment for sharing insights, asking questions, and collaborating on trading ideas. This sense of community adds an extra layer of value, as traders can continue to learn and grow beyond the structured course curriculum.

In conclusion, Michael Valtos’ Order Flow Trading Course is a valuable resource for traders looking to elevate their understanding of market dynamics and improve their trading outcomes. With a focus on practical application, risk management, and community support, the course equips participants with the tools and knowledge needed to navigate the complexities of order flow trading successfully. Whether you are new to order flow analysis or looking to enhance your existing skills, Valtos’ course provides a structured and insightful learning experience.

Please note that this course is different from Mike Valtos – The Order Flow Edge Trading Course: https://www.atslibrary.com/product/mike-valtos-the-order-flow-edge-trading-course/

Over 1.000 comments

Over 1.000 comments