The Ultimate Guide to VWAP

VWAP On Demand

(Course and Indicators 2023 Updated)

In-depth education focusing on the market’s most overlooked technical indicator — volume weighted average price.

Why use VWAP?

Institutional traders have been utilizing advanced applications of volume-weighted average price for decades, but it’s chronically misused by the majority of retail traders.

By incorporating additional concepts like standard deviation bands and longer-term anchored VWAPs, you’ll start to uncover otherwise hidden levels of support and resistance that are hiding in plain sight.

Meet our founder, Zach Hurwitz.

A full-time trader since 2008, Zach has dedicated nearly his entire career to studying and using volume-weighted average price.

THE VWAP – Course and Indicators 2023 Updated – Full Package for ThinkOrSwim

What’s included?

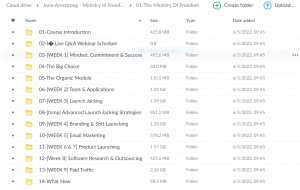

- Over 8 hours of video modules

- Six custom-coded VWAP indicators

Get instant access more video lessons covering key concepts like

- Applying standard deviation bands to characterize chart behavior

- Identifying and evaluating our four primary intraday trade setups

- Interpreting the slope of VWAP to discern market health and style

- Anchoring long-term VWAPs to critical events

- Prioritizing the best setups and creating a trade plan

- Controlling your risk and managing ongoing trades

Custom-coded indicators you can’t find anywhere else

Unlock the full potential of volume-weighted average price with a newfound ability to plot standard deviation bands, track key metrics, anchor VWAPs to any specific point in the past that you wish, and analyze foretelling volume patterns.

Each indicator is discussed in-depth during the course, including comprehensive tutorials on their functionality, features, and best uses.

Over 1.000 comments

Over 1.000 comments